How to do Intraday Trading?

In this article, we are going to focus on Intraday Trading or Day Trading. We will learn what it is, some terminologies related to it, and some basics of how it’s done.

Table of Contents

Table of Contents- What is Intra-day Trading?

- How to do Intraday Trading? - Intraday Trading Strategies

- Advantages and Disadvantages of Intraday Trading

What is Intra-day Trading?

In share market, we can buy securities in two ways – for a limited tie-period of one day, or for an unlimited period.

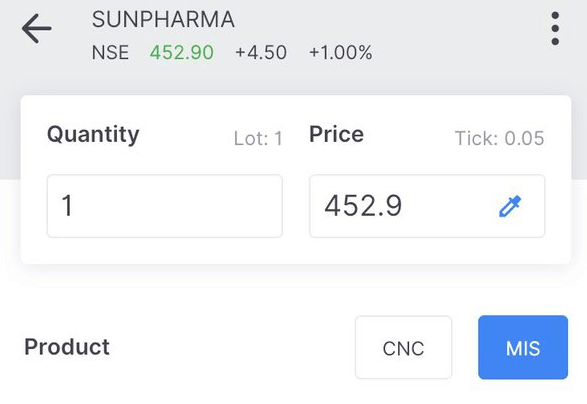

- In Intra-day Trading we have to buy and sell (or sell and buy) our securities (be it shares, or derivatives) within the same day (by 3:30 PM). That is, herein we close the position on the same day. We can do so using cash or margin. The technical term used for intra-day trading is Margin Intraday Square Off (MIS).

- When we take delivery of securities (e.g. shares), we can hold it for more than a day. This is also known as Swing Trading or Positional Trading. We can also take multi-day positions in derivatives. We can do so using cash or margin. The technical term used for delivery or positional trading is Cash and Carry (CNC) or NRML.

Cash Trading Vs. Margin Trading

Cash Trading Vs. Margin TradingIn share market, we can buy securities either with the money we already have, or we can take loan from our broker.

When a person is doing Cash trading, he’s simply trading (buying and selling) securities using cash on hand rather than using margin money.

When we use borrowed capital, we call it margin (or brokers margin, or leverage). Leverage/Margin is the extra fund that the broker provides for your trading. This allows traders to trade with even low capital. That is, they can buy much more securities with broker margin than they would otherwise have afforded. Generally, brokers charge interest on margin money.

We can use both cash and margin in almost all types of tradings in stock market, be it stocks, or derivatives (options, futures).

How to do Intraday Trading? - Intraday Trading Strategies

Intraday traders make use of various strategies to make profits. Generally, they prefer one or just a couple of strategies that work for them.

- Range trading: This is the most traditional and famous method that intra-day traders use. Here they primarily make use of support and resistance levels to determine right entry and exit points (i.e. buy and sell decisions).

- Scalping: This strategy is also used by some traders, who are often called scalpers. Herein, the aim of the traders is not to make huge profits. Rather they aim to make a number of small profits on small prices changes throughout the day. Scalping needs one to be very fast in decision making and execution.

Some traders also use sophisticated algorithms, data, and indices (e.g. PCR data, Moving Averages, etc.) to exploit small or short-term market inefficiencies.

How to choose stocks for Intraday Trading?

There are various rule-of-thumbs that traders use while choosing suitable stocks for intra-day trading.

- High Volatility: Experts suggest us to choose stocks that show some volatility, i.e. some up and down price action. If a stock is moving sideways, you won’t be able to book profits in it as a trader. However, some experts also suggest us to avoid stocks that are too volatile and unstable, i.e. the stocks that show unpredictable price action. That’s why some experts stick to the stocks of blue-chip companies for intra-day trading. While trading, your aim is to recognize the trend (uptrend, downtrend, or sideways trend) and follow it, i.e. follow the herd rather than being a lone wolf. Apart from the trend in the stock, you also need to recognize the trend in that sector and the market as a whole.

- High Liquidity: The stocks you choose should have some trading volume. If many people are not trading in that stock, you won’t see much price action in that stock. Also, if you intend to buy or sell a share, there must be someone that is willing to sell it to you, or buy it from you. If trade volume is too low, you may not find any. Remember, stock market is just a platform for buyers and sellers of shares and derivatives to trade.

Apart from these, traders also make use of the following to choose the stocks to trade in:

- News-based trading: Traders keep up to date with financial current affairs with an aim to seize trading opportunities from the heightened volatility around news events. For example, if you know that aviation fuel prices have increased, the stocks of various airlines (especially the ones not doing good) are bound to fall the next day.

- Blue Chip or Large Cap shares or Indexes: Some traders restrict their trading to big shares and indexes such as NIFTY and NIFTY Bank. It’s safer and there’s always enough volume for you to trade without hiccups. For the record, NIFTY Bank index is more volatile than NIFTY index.

Whatever you do, the stocks you want to trade in must be well-researched by you. Do not rely on your luck – that will make you a gambler, not a trader!

Some intra-day traders think that we will search for the right stocks and trends on that day only. But it’s not a good practice.

Stocks trends continue over multiple days. If you see the trend of a stock on the previous day(s), you may predict its trend on the next day to a large extent. So, traders should do their homework a day before they trade. That is, once trading stops at 3:30 PM, you should start preparing for the next day - choose the appropriate stocks.

Advantages and Disadvantages of Intraday Trading

Now, let’s have a look at some of the advantages and disadvantages of intra-day trading.

Advantages of Intraday Trading

- You need not focus on long-term growth prospects of a stock, and fundamental analysis of that company. All you need to do is technical analysis – understand price action, candlestick patterns, chart patterns, data analysis, etc. So, an intra-day trader is insulated from overnight news or off-hours broker moves to a certain extent. That’s because they start everyday fresh; they do not carry over their positions overnight. They book their profit/loss the same day.

- If you are a regular trader, you may become eligible for higher leverage from your broker. However, trading on borrowed margin money is much riskier too. Keep that in mind.

- Traders make many trades in a day. This hands-on-learning-experience makes them better technical analysts. Technical analysis is useful not only in intra-day trading, but also for long-term investment (i.e. positional trading).

- While trading you can make money even if the stock is falling. While in long-term investment you make money only if the stock price moves up.

Note

NoteThough we can short shares too (apart from options and futures), i.e. we can sell them first and then buy them later. But this can only be done in intraday trading. If you want to hold your short positions over multiple days, you need to do it via futures/options.

Disadvantages of Intraday Trading

- Intra-day trading is riskier than positional trading. Here you have to close your positions the same day, whether you are in a profitable position or making loss. So, intra-day traders must do risk analysis, do proper research, and always trade with a stop loss. Conserving capital is more important than making profits.

- Multiple trades mean multiple commission costs.

- Not all securities can be traded in intra-day, e.g. mutual funds.