What is Swing Trading?

Most of us are aware of the concepts of intra-day, scalping, and options/futures trading. But we can also do Swing trading. It’s a term that most of us have at least heard once, but most of us do not know what it exactly means.

In this article, we will try to understand what swing trading is and some tips and tricks related to it.

Note

NoteUnlike options/futures, which are risky derivative tools, and need a deep knowledge of share market, trading in cash can be done by relatively new traders too – so newbies may do cash intra-day, scalping, swing trading, and positional trade. (Positional trade means long-term investment – at least for more than a day).

What kind of trading suits you the most will depend on your temperament and aptitude. Try out the various kinds of tradings and see what proves to be the most beneficial to you. As per some swing trading experts, you may get much higher returns through swing trading than via long-term share market investment, or through mutual fund or index fund investment. Only options/futures trading can beat it, but then those are very risky too.

Table of Contents

Table of Contents- Swing Trading

- Tips of Swing Trading

Swing Trading

We know that price of any given share, index, cryptocurrency, forex, or currency is generally a zig-zag line. It goes up, goes down, and then up, and so on. This is what we call a swinging pattern.

Traders that make use of this swinging pattern of a chart are called Swing Traders. They wait for a breakout and get out of the trade as soon as they see a decent profit.

Note

NoteUnlike intra-day traders who wait for small breakouts (that may even give them 2-4% profit) that may come every few minutes or hours, swing traders aim for bigger breakouts (that may give them 8-10% profits) spanning a few hours or days.

Swing Trading can be done in intra-day. But mostly it is done over a period of 3-5 days, i.e. in a positional trade.

The aim of swing trading is to make a decent amount of profit (like a pocket money) and get out of the trade. They do not invest for weeks or months. As it is a short-term investment (can be called trading), such an investor/trader must take quick decisions.

Swing traders view share market investment as a business. So, they do not lock their capital at one place for too long. They will invest long term (i.e. take a positional trade) in a share only if they are very much sure that it can grow leaps and bounds in months/years to come. Generally, swing traders do a much deeper share analysis, and if they see that some share that they bought with swing trading perspective is good enough for long-term holding, then they may do so. This is a flexibility that swing traders enjoy. We generally say that traders should not become investors midway, but this does not apply to swing traders.

Note

NoteSometimes, the market is not suitable for intra-day trading (e,g, when it is moving sideways), while at other times the market is not suitable for long term investment (e.g. when it is falling or is very volatile). However, in swing trading you always keep on getting opportunities for trading. You may easily get 2-3 good swing trading opportunities in a month, no matter how the market is behaving (good trading opportunity means the trade that allows us to gain at least 10%).

In swing trading our aim is to trade between the support and resistence levels. We try to enter near the support and exit at the resistence. So, we try to make profit per swing.

- We buy at the lowest point possible, which is generally near the support level. And then sell at the highest point possible, which is generally near the resistence level.

- We sell at the highest point possible, which is generally near the resistence level. And then buy at the lowest point possible, which is generally near the support level.

Some people enter trade only when there is a breakout, rather than just looking at support-resistence levels. They select stocks that break 52 week high or low. This allows them to book profits faster. This way their capital does not remain blocked in the same stock for long. To confirm the breakout you may use VWAP, Super Trend, RSI, etc. All these allow you to enter the trade right near the bottom, rather then after the price has already rose a lot.

Trade entry and exit will depend on your technical analysis, strategy, the indicators you rely on, etc.

Tips of Swing Trading

To make profits through swing trading there are various tricks and strategies that traders often use. Let us share a few of them with you.

Do not try to make all of your profits via the same share

In general, if you analyze good performing shares, you will observe that:

- Generally, if you have invested in a share at the right time, it will provide you around 10% profits in the first month itself. After that the rate of profit slows down – it may take you around a year to get the next 10% profit. Swing traders do not block their capital in a particular share for too long. They would rather invest in another share that can provide them another 5-10% profit in a month.

- After a minor breakout, a share may again come down. If you wait for too long, you will miss this opportunity. Swing traders do not wait for multiple major swings. They book the profit per swing of a share. That’s why as per some experts swing trading is less risky than long-term investment. (Swing traders keep a smaller stop loss than long-term investors, further reducing the risks involved. Bigger stop loss may cause you bigger losses too.)

Focus more than Diversification

Though most swing traders take up a positional trade, they do not focus on more than 3-4 shares at a time. That is, swing traders invest in 3-4 shares for a few days and observe them cautiously. They get out of the trade as soon as they get the opportunity. Even while choosing they analyze a stock in a much deeper way. Their aim is to increase their accuracy (at least 3 out of the 4 shares must give them profits).

On the other hand, long-term investors, who invest for months/years, aim to diversify their portfolio. In general, it is suggested that you invest in 10-15 different shares if you are a long-term investor.

Doji Candlestick Pattern Strategy for Swing Trading

Candlestick patterns are something that are used by traders and investors alike. It’s true in case of swing trading too.

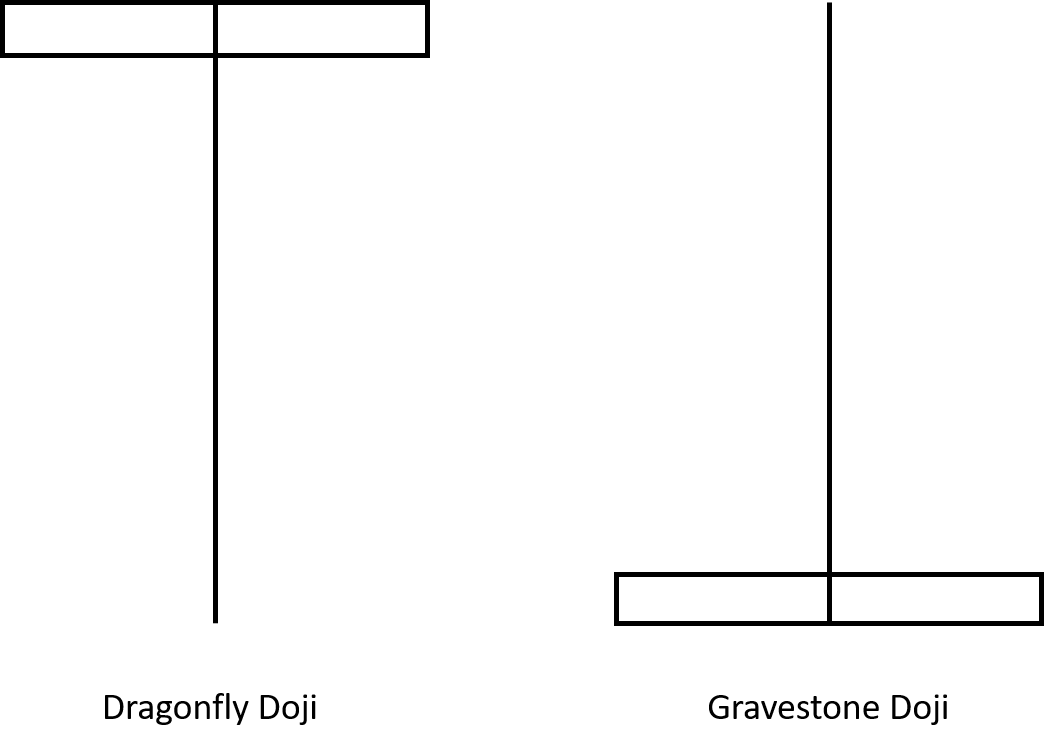

One strategy of swing trading involves Doji Candlesticks – these candlesticks have a very small (almost non-existent) body and a very big upper or lower wick. Doji is formed when a candlestick closes at the same point where it started. It’s generally black in colour and it signifies that the sellers and buyers in the market are almost putting in the same effort, i.e. as many shares are being bought as they are being sold.

These are of three types:

- Dragonfly Doji has a very long lower shadow wick. A green Dragonfly Doji signifies that the price of the stock went very low from the point it opened (i.e. sellers sold a lot of shares), but it recovered and closed at a higher point (i.e. buyers won the final battle). Say, a stock opened at Rs. 100, wend down till Rs. 66, and then closed at Rs. 102. If it is formed at the lower part of the chart (i.e. when there is a bearish swing), then it signifies that an uptrend may come.

- Gravestone Doji has a very long upper shadow wick. A red Gravestone Doji signifies that the price of the stock went very high from the point it opened (i.e. buyers bought a lot of shares), but it collapsed and closed at a lower point (i.e. sellers won the final battle). Say, a stock opened at Rs. 100, wend up till Rs. 134, and then closed at Rs. 98. If it is formed at the upper part of the chart (i.e. when there is a bullish swing), then it signifies that a downtrend may come.

- Long-legged Doji : They have a negligible body, and a pretty long upper and lower shadow wick. If such a doji is formed at the upper part of the chart, then it signifies that a downtrend may come. If such a doji is formed at the lower part of the chart, then it signifies that an uptrend may come.

There must be a swing before Doji, otherwise it has no significance. For example, if a Dragonfly Doji (or Long-legged Doji) is formed during a downtrend, or if Gravestone Doji (or Long-legged Doji) is formed during an uptrend. They have no meaning when they are formed during a sideways market trend.

In general, you can aim to book 8-10% profits using this strategy. Put the stop loss at the low of the Doji if you expect an uptrend. Put the stop loss at the high of the Doji if you expect a downtrend.

Note

NoteSpinning Top candlestick pattern is very similar to Long-legged Doji pattern. The only minute difference is that the body of a doji is almost negligible or non-existent, while spinning top may have a small body.

Warning

WarningThere are hundreds of candlestick patterns, but most of them are useless, as they do not give us strong clues regarding an upcoming trend-change in the market. Only a few of them are good – Doji pattern being one of them.

Some more tips:

- Though most swing traders aim to make just 5-10% profits per trade, you may maximize your profits using finnacial news. To make the maximum possible profits in swing trading, you should combine technical analysis with news based trading. That is, buy a stock that has potential to grow based on some news. Then double check its chart. If technical analysis also gives you a green signal, go forward and buy it. So, news also allows us to choose right stocks for swing trading.

- Always select a stock that has enough trade volume. Do not select a stock that has very low trading volume, or in which the operator (or big bulls) is known to play tricks. To be safe, trade only in the stocks of big and well-known companies.

- As per some experts, in swing trading you should rely more on chart based price action, rather than on indicators. For example, when flag chart pattern is formed, swing traders tend to make huge profits.

- When the price moves in a tight range for a long-time, i.e. gets stuck sidways, it shows price consolidation. Sometimes we get a huge breakout in such stocks in due course of time, especiallly if you see that the trade volume is increasing.

- ALways use a trailing stop loss.

- Along with learning to do swing trading, also learn when not to do swing trading. Do not enter the trade until and unless all items of your checklist are checked.

Advantages of Swing Trading

- In swing trading you need not sit in front of the screen continuously. The holding time in swing trading can be anywhere between 2-3 days to much more. So, unlike intra-day trading, here you may buy the stock and then relax.

- Swing trading is not as risky as intra-day trading.

- Swing traders do not run the risk of over-trading. They trade only when they see a very good opportunity. So, your brokerage costs are automatically going to be minimal.

Disadvantages of Swing Trading

- Risk of overnight bad news: If some bad news comes along overnight, your stock may collapse. Say, if the company’s quarterly report is gloomy, or governemnt passes a law that is detrimental to the interests of that company, etc.

- Most wealthy people in stock markets make their wealth via long-term postional trading. If you are doing swing trading, you will most probably just focus on short-term 5-10% profits, and may miss out on long-term mega profits. But you may do swing trading without any fundamental analysis, which requires you to do a lot of research. Swing trading allows you to skip that hard work.

Note

NoteIf you do swing trading after doing some fundamental analysis, you may decide to remain invested in that stock for long-term midway through your trade, if you deem fit. After all, you have taken delivery of the stock (CNC). Though it’s not a good idea to change your trade aim midway, swing trading allows you to move to a positional stand midway if you wish to stay put long-term, rather than book quick profits/losses. So, if you are one of those people who hate booking losses and place a stop loss, you should definitely trade only in a stock that has strong findamentals and long-term growth potential. That will allow you to avoid booking losses in swing trading; you may stay invested in that stock long-term. But your capital will get stuck in that stock for that amount of time.

Winding Up

This was a very small effort on our part to introduce you to the universe of swing trading. There are a multitude of strategies that swing traders use to be successful in this effort of theirs. We will keep on sharing with you our knowledge with time. Of course, we also encourage you to do your own research and practice to become proficient in this craft.

Swing trading allows you to generate a regular monthly income. This is something that long-term investment cannot provide you. Swing trading is also a bit less risky than intra-day trading, as here you are taking a positional trade – you may hold on to the share for long term too if you do not get a good opportunity to sell it in a few days. While in intra-day, generally, you have to sell the share the same day, whether you are in a profitable position or not. In intra-day you have to capture the minor price movements of the share and have to be much more vigilant.

If you are a long-term investor, and you want to start trading, then swing trading may be a good starting point for you.